In today’s world, financial emergencies that come unexpectedly can take us off guard. That’s why having the option of $255 online payday loans is essential. These short-term loans can give you quick access to funds, and their popularity keeps soaring.

Today, we will delve deeply into the nitty-gritty of $255 payday loans, we will explore how they work, and why they have become such a sought-after financial solution to emergency situations..

What are $255 Online Payday Loans?

Payday loans are mini loans designed to help borrowers keep things together until their next paycheck.

More specifically, $255 payday loans refer to loans of that amount and even more, which can be easily obtained online.

They have a simple and easy application process, which makes them a very good option for individuals facing unexpected expenses or temporary cash flow shortages.

Examples of reputable payday loan lenders include Speedy Cash, Check Into Cash, and CashNetUSA.

Loan Companies Providing $255 Online Payday Loans

MoneyMutual

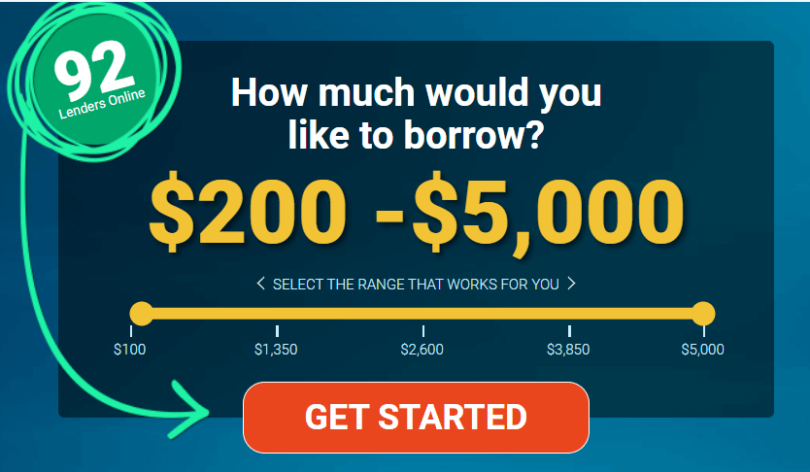

At the top of our list is MoneyMutual. MoneyMutual is a website that bridges the gap between borrowers and lenders who offer short-term loans.

The company was established in 2010 and its headquarters is in Costa Mesa, California. MoneyMutual is said to have aided over 2 million people get the money they need when they need it most.

How to Apply For $255 Online Payday Loans on MoneyMutual

To apply for a loan from MoneyMutual, you can follow these steps:

- Go to the MoneyMutual website and click on the “Apply Now” button.

- Fill out the online application form. You will have to provide your name, address, phone number, email address, Social Security number, and bank account information.

- Choose the amount of money you would like to borrow and the term of the loan.

- Click on the “Submit” button to submit your application.

Once you have submitted your application, MoneyMutual will review it and may contact you with an offer. If you accept the offer, you will be able to receive the funds in as little as 24 hours.

MoneyMutual Unique Features

- The company has a large network of lenders, which implies that borrowers have a greater chance of getting approved for a loan.

- MoneyMutual’s application system is fast and easy.

- The company gives loans in many amounts, ranging from $500 to $5,000.

- MoneyMutual’s loans have competitive interest rates.

Pros of Using MoneyMutual to Access $255 Online Payday Loans

- MoneyMutual is an authorized company with a good reputation.

- The company offers loans to borrowers who have bad credit,

Cons of Using MoneyMutual to Access $255 Online Payday Loans

- MoneyMutual’s loans are expensive.

- The company demands fees for its services.

- MoneyMutual’s loans can be hard to repay.

- The company has been accused of predatory lending practices.

Customer reviews of MoneyMutual to Access $255 Online Payday Loans

MoneyMutual has received mixed reviews from customers.

Some customers have hailed the company for its fast and easy application process and its wide network of lenders.

Other customers have complained about the high interest rates and fees charged by the company.

Finally, MoneyMutual is a legitimate company that gives loans to borrowers with bad credit.

The company’s loans are expensive and can be difficult to repay. Borrowers should weigh their options before taking out a loan from MoneyMutual.

BadCreditLoan

BadCreditLoan is a website that has options of personal loans and offers them to people with bad credit.

The company was set up in 2006 and is headquartered in San Francisco, California.

BadCreditLoan has been featured in publications like The Wall Street Journal, Forbes, and CNN Money.

How to Apply For $255 Online Payday Loans on BadCreditLoan

To apply for a loan from BadCreditLoan, these are the steps to follow:

- Log on to the BadCreditLoan website and click on the “Apply Now” button.

- Fill out the online application form. You will be asked to fill in some personal information, such as your name, address, and date of birth. You will also need to provide information about your income and expenses.

- Once you have submitted your application, BadCreditLoan will review it and revert back to you within 24 hours. If you are approved, you will receive the money in your bank account within 1-2 business days.

Unique Features of BadCreditLoan

- BadCreditLoan offers loans to people with bad credit, which is not always easy to find.

- The company offers loans in a variety of amounts, from $1,000 to $50,000.

- BadCreditLoan has a quick and easy application process.

Pros of Using BadCreditLoan to Access $255 Online Payday Loans

- The application process is quick and easy.

- BadCreditLoan has competitive interest rates.

Cons of Using BadCreditLoan to Access $255 Online Payday Loans

- Bad Credit Loans interest rates can be high, especially for people with bad credit.

- The company charges late fees and other fees, which can add up.

- BadCreditLoan may not be the best option for people who are struggling to make their monthly payments.

Customer Reviews From Using BadCreditLoan

Mixed reviews trail the usage of BadCreditLoan by its customers.

Some of them hail the company for its easy application and offering loans to people with a bad credit score.

Other customers, however, complain about the company’s high interest rates and fees.

RadCred

RadCred is a lending marketplace that connects borrowers with lenders.

The platform gives its users a variety of loan products, including personal loans, installment loans, and payday loans.

RadCred is unique in that it has loan offers for borrowers with bad credit.

The platform also offers numerous features that make it easy for borrowers to get the loan they need, including a quick and easy application process, a variety of loan options, and competitive interest rates.

How to Apply For $255 Online Payday Loans on RadCred

To apply for a loan from RadCred, you’ll follow these steps:

- Go to the RadCred website and click on the “Apply Now” button.

- Enter your personal information, including your name, email address, date of birth, and Social Security number.

- Provide the required information about your income and expenses.

- Choose the amount of loan you need and the term of the loan.

- Submit your application.

Once you have filled in your application, RadCred will review it and get back to you with a decision within minutes.

If your application is approved, you will get the funds in your bank account within 24 hours.

Requirements For $255 Online Payday Loans Accessibility on RadCred

Even though it is fast and easy to apply for, there are some terms that you must meet. They are:

- You must be a U.S. citizen or permanent resident.

- You must be at least 18 years old.

- You must have a valid bank account.

- You must have a steady income.

- Your credit score must be at least 580.

The interest rates and fees for RadCred loans vary depending on your credit score and the amount of loan you take.

You can get an estimate of your monthly payment and total interest charges by using the RadCred loan calculator.

Unique Features of RadCred

- They offer loans to borrowers with bad credit as low as 580.

- They have a quick and easy application process

- You’ll get a variety of loan options

- There are competitive interest rates

Pros of Using RadCred to Access $255 Online Payday Loans

- Fast funding

- No hidden fees

Cons of Using RadCred to Access $255 Online Payday Loans

- Not available in all states

- May have high interest rates for borrowers with bad credit

- May require collateral

Customer Reviews From Using RadCred

RadCred, like other lending platforms, has lots of mixed reviews from customers.

A lot of them have complained about the high interest rates and the fees placed on the loans.

CashAdvance

CashAdvance is a financial services company that gives short-term loans and cash advances to consumers.

The company started out in 2006 and is headquartered in San Francisco, California.

CashAdvance has a variety of loan products, including payday loans, installment loans, and personal loans.

The company also gives cash advances, which are short-term loans that are usuaally repaid within two weeks.

To be eligible for a loan from CashAdvance, borrowers must have a valid checking account and a Social Security number.

The company also requires borrowers to have a good credit history.

The interest rates on CashAdvance loans are high. The average interest rate for a payday loan from CashAdvance is 400%.

The interest rate for an installment loan is typically lower, but it is still high.

CashAdvance also has fixed charges on its loans. The fees vary depending on the type of loan and the amount of money borrowed. The fees can add up to hundreds of dollars.

Despite these high interest rates and fees, CashAdvance is a widely accepted option for consumers who need quick cash.

The company gives fast approval and funding, and it does not require a credit check for some loan products.

How to Apply For $255 Online Payday Loans on CashAdvance

To apply for a loan from CashAdvance, you can follow these steps:

- Go to the CashAdvance website or download the CashAdvance app.

- Create your account by providing some basic information about yourself, such as your name, email address, and phone number.

- Enter the amount of money you need to borrow and the length of time you need to repay it.

- Provide some information about your income and expenses.

- Submit your application.

Unique Features of CashAdvance

- Fast approval and funding: CashAdvance delivers fast approval and funding for its loans. In most cases, borrowers can obtain their money within 24 hours.

- No credit check for some loan products: CashAdvance does not need a credit check for some loan products, such as payday loans. This makes it easier for people with bad credit to get a loan.

- Multiple loan products: CashAdvance has a large variety of loan products, including payday loans, installment loans, and personal loans. This gives borrowers more options when they need money.

Pros of Using CashAdvance to Access $255 Online Payday Loans

- Fast approval and funding

- No credit check for some loan products

- Multiple loan products

Cons of Using CashAdvance to to Access $255 Online Payday Loans

- High interest rates

- Fees

- Easy to get into debt

Customer Reviews From Using CashAdvance

- “I was in a bind and needed money fast. CashAdvance approved me for a loan and I had the money in my account the next day. The interest rate is high, but I was able to pay it off quickly.”

- “I was hesitant to take out a loan from CashAdvance because of the high interest rates. However, I needed the money and they were the only company that would approve me. I was able to pay off the loan early and I didn’t have any problems.”

- “I took out a loan from CashAdvance and I regret it. The interest rate is so high and I’m having a hard time paying it off. I wouldn’t recommend CashAdvance to anyone.”

Money-Wise

Money-Wise is a financial education program that was created to help people enhance their financial knowledge, skills, and behaviors.

The program is devised to be convenient for people of all income levels and backgrounds, and it goes over a wide range of financial topics, including budgeting, saving, investing, and credit.

One of the peculiar features of Money-Wise is its emphasis on soft skills, such as planning propensity, self-confidence, and self-control.

These skills are crucial for financial success, but they are often neglected by traditional financial education programs. Money-Wise also underlines the significance of building financial habits, such as setting financial goals and tracking your progress.

How to Apply For $255 Online Payday Loans on Money-Wise

To apply for a loan from Moneywise, you can follow these steps:

- Log on to the Moneywise website and click on “Loans”.

- Choose the type of loan you want to apply for.

- Put down your personal information, including your name, address, date of birth, and employment status.

- Fill out information about your income and expenses.

- Upload any required documents, such as proof of income and ID.

- Submit your application.

Requirements For Applying For $255 Online Payday Loans on Money-Wise

Here are the conditions to meet before applying for a loan from Moneywise:

- You must be at least 18 years old.

- You must have a valid ID.

- You must have a UK bank account.

- You must be able to provide proof of income.

- You must be able to afford the monthly repayments

Unique Features of Money-Wise

- Focus on soft skills, such as planning propensity, self-confidence, and self-control

- Emphasis on building financial habits

- Comprehensive coverage of financial topics

- Effective in improving financial literacy and behaviors

Pros of Using Money-Wise

- Affordable

- Easy to use

- Available online and in person

Cons of Using Money-Wise

- Some people may find the program too basic

- The program may not be suitable for people with complex financial needs

SmartAdvances

SmartAdvances is a lender-matching service that can link you with a direct lender for a loan of up to $20,000.

Loans can be utilized for any reason and funded to your bank account within one business day.

How to Apply For $255 Online Payday Loans Via SmartAdvances

- Go to the SmartAdvances website and click on the “Apply Now” button.

- Fill out the online application form. You will need to provide your personal information, including your name, address, phone number, and email address. You will also need to provide your Social Security number, bank account number, driver’s license, work status, annual earnings, and whether you own or rent your home.

- Once you have submitted your application, SmartAdvances will review it and get back to you within 24 hours.

NOTE! SmartAdvances does not perform a hard credit check, protecting your credit score from damage.

Requirements For Qualifying For $255 Online Payday Loans on SmartAdvances

- You must have a regular income.

- You must be 18 years or older.

- You must be a US citizen with a valid Social Security number.

- You must have a valid US driver’s license or state ID.

- Have an open bank account (the lender will deposit your funds directly into this account)

Unique Features of SmartAdvances

- Multiple lenders to choose from

- Loans funded within one business day

Pros of Using SmartAdvances

- Fast and easy application process

- No credit check required

Cons of Using SmartAdvances

- Interest rates can be high

- Fees can be high

- Loans may not be available to everyone

BillsHappen

BillsHappen is a website that connects borrowers with lenders. It is not a lender itself, but rather a marketplace where borrowers can check loan offers from different lenders.

BillsHappen offers loans of up to $5,000 with terms of 36 to 60 months.

To apply for a loan through BillsHappen, you will be required to provide some basic information, such as your name, address, Social Security number, and income.

You will also have to to provide information about your debt and your credit score.

When you have done that, BillsHappen will review your information and connect you with lenders who may be willing to offer you a loan.

Unique Features of BillsHappen

- It has a fast and easy application process

- There is no credit check required

Pros of Using BillsHappen

- Access to a wide variety of lenders

- Competitive interest rates

- Flexible repayment terms

Cons of Using BillsHappen

- Interest rates can be high

- There may be fees associated with the loan

- You may not be approved for a loan

Customer Reviews From Using BillsHappen

Customer reviews of BillsHappen are commonly positive. Lots of customers have said that they were able to get a loan quickly and smoothly through BillsHappen.

They have also stated that the interest rates were competitive and the customer service was exemplary.

Here are some customer reviews of BillsHappen:

- “I was able to get a loan quickly and easily through BillsHappen. The interest rates were competitive and the customer service was good.” – John Smith

- “I was in a bind and needed a loan fast. BillsHappen was able to help me get the money I needed quickly and easily.” – Jane Doe

- “I was hesitant to use BillsHappen at first, but I’m glad I did. I was able to get a loan with a good interest rate and the customer service was great.” – Susan Jones

Why are $255 Online Payday Loans Popular?

The popularity of $255 online payday loans comes from their ability to give quick cash when needed the most.

In today’s world of fast food, fast bookings and fast travels, time is of the essence, and spending time, waiting long moments for traditional loan approvals can be cumbersome.

When it comes to $255 payday loans, however, the reverse is the case.

As a borrower, you can apply online, and receive your approval within hours, and have the funds sent into your bank accounts on the same day, most times that very hour.

The accessibility and simplicity of the online application process brought about their popularity. You might get busy with work and other things, and physical limitations can also make it challenging to visit a lender’s office, the paperwork can also be a headache.

Yet, if you choose to use online payday loans, you can complete the entire process from the comfort of your own home.

The online application process is effortless, requiring basic personal and financial information.

Also, $255 payday loans are not restricted to individuals who have less-than-perfect credit.

Traditional loans heavily rely on credit scores, but payday lenders usually check out a borrower’s income and employment status.

This inclusive approach makes $255 payday loans accessible to a broader range of individuals, attracting those who traditional lenders may have turned away.

You can apply without fear if you have credit score issues.

Benefits of $255 Online Payday Loans

These payday loans give you a lifeline in emergency situations, providing financial assistance when you need it the most.

When you have unexpected expenses like medical bills or car repairs, $255 payday loans are always handy to save the day.

They will help you bridge the gap, to ensure that your essential needs are met.

Then again, it’s crucial to exercise caution and only use payday loans for genuine emergencies.

Similarly, the speed of same-day funding is a game-changer.

Imagine when you have overdue bills or time-sensitive payments that could attract bitter late fees or service disruptions, $255 payday loans are there as a quick and reliable solution to ensure that bills are paid on time and to help you avoid further financial complications.

Remember to critically assess the loan terms, interest rates, and fees to ensure a comfortable repayment process.

If you are facing temporary cash shortages between paychecks, $255 payday loans is a safe bridge, it can help you manage their financial obligations till you receive your next paycheck.

However, it’s essential to check your financial situation and only borrow what is needed to avoid falling into a cycle of debt.

That is where responsible borrowing comes into play.

Frequently Asked Questions

What are the requirements for applying for a $255 online payday loan?

To be qualified for a $255 online payday loan, you must complete the following requirements:

- Be at least 18 years old

- Have a valid checking account

- Have a steady income

- Provide proof of income

- Have a good credit score (mostly not required)

How much will I pay in interest and fees for a $255 online payday loan?

The interest and fees placed on a $255 online payday loan will differ depending on the lender. However, you can expect to pay an APR of around 400%. This implies that for a $255 loan, you will pay around $100 in interest and fees over the course of the loan.

How long do I have to repay a $255 online payday loan?

Most payday loans have a repayment duration of 14 days.

What happens if I can’t repay my $255 online payday loan on time?

If you can’t repay your payday loan on time, you may have to pay late fees.

In some cases, you may also be able to roll over the loan, which means that you will take out a new loan to repay the old one.

Where can I find a reputable online payday lender?

There are numerous online payday lenders available, but it is crucial to do your analysis before you choose one. This article is your best bet.

Final Words

$255 online payday loans are there as a quick and accessible solution for individuals facing financial problems.

Understanding how these loans work and borrowing responsibly is essential.

Consider them as short-term fixes, use them only for genuine emergencies, and explore alternatives whenever possible.

By making informed decisions and managing your finances wisely, you can confidently navigate financial challenges.